Lessons from Fundraising Successes and Failures

- Intro

- Lesson 1: Communication and Timing Matters

- Lesson 2: Be Open to Learning, Be Prepared

- Lesson 3: Building Key Materials

- Lesson 4: Starting (and Continuing) the Conversation

- What Worked for Us

- What Didn't Work for Us

- Our Seed Round in Numbers

- Inside the Funding Amounts

- In Closing

(If you're only interested in charts and numbers, scroll down to Our Seed Round in Numbers!)

When any founder shares stories of growing their startup, it can be tempting to focus only on the positives.

Those moments where a vast investment was secured or the team hit a milestone in building our core technology are absolutely worth sharing – they can be inspiring and motivational for others building up a business. But in truth, making a startup a success involves a lot of persistence, rejection and failure – and those more difficult moments are so often where the most useful lessons can be learned. Yet seldom do people highlight these challenging times.

Since announcing the news of our successful $2 million seed round last year, we've had handfuls of founders reach out to ask about our fundraising process. We've happily jumped on video calls with them and walked them through what worked for us. Eventually it felt only logical to put all of this down in writing.

We also wanted to offer some insights into the other side of the coin – lessons from the failures and challenges that will be valuable to anybody in games or otherwise building an ambitious company. And be sure that every founder will face failures. It's part of the process. Reading this won’t magically shelter you from anything but success. But in looking at our journey, you’ll see there’s a lot to be learned about getting things right by considering what didn’t quite go to plan..

When I co-founded LootLocker in 2019, I wasn’t a first time founder. I’d founded and run a few game studios, successfully raised money several times over, and learned a lot about getting it right. So everything that followed should have been fairly straightforward, right?

Well, not exactly.

When we first attempted to raise $1.5m th a seed round in February 2021, it wasn’t to be. We learned that while pitching a game studio to investors might appear fundamentally comparable to pitching a game technology company, it required a rather different approach. Ultimately, something like backend technology is more abstract than a game itself, and not all investors are deeply familiar with the technology behind the games they might fund.

Lesson 1: Communication and Timing Matters

We learned a lot in those moments – about how important it is to be sure you are communicating concepts and potential as simply as possible when giving initial pitches. And it’s not just about being clear; you need to think carefully about what investors actually need to know at the initial pitching stage. Provide a sense of value and impact, rather than bewildering potential backers with technical terminology and feature deep dives. They need to understand what your product does, sure, but consider how to communicate the differences it will make to the end-user’s life and the reasons this has the potential to be huge. Because that is what these people are actually investing in.

Now, our first shot at a seed round might not have succeeded, but we still got a lot right. We spoke to two dozen investors over a month; and before we started pursuing a cash injection we agreed on that time frame. When the month was up, if we hadn’t secured funding, we’d go back to working on the product, business and team. We didn’t want to be a company stuck in eternal funding limbo – which itself can be a death sentence. I’ve been there before, and it’s never a good look for investors. Equally, it can be very distracting from getting on with growing your company. And as we learned, that growth is critical in convincing investors their money's worth putting behind your business.

Lesson 2: Be Open to Learning, Be Prepared

We also realised we had more to learn about getting all this right, despite our team’s experience. And that’s the next key lesson. We were open to learning. That attitude led us to the Techstars program, which saw us travel to the US and spend 12 weeks with a group of other amazing startups, and a range of deeply experienced experts and mentors. We topped up our knowledge on growing our product, growing our business, pitching, and working with investors. We made contacts and found opportunities and – importantly – had a point of proof to show potential future backers that we were open to learning and adapting. Again, this all came after I’d successfully raised north of $2 million at other game companies. I generally knew what I was doing; but I can always know more.

The most important element of our Techstars journey, perhaps, was in getting a new perspective on preparing to raise money. Raising a round is usually not successful if you’re not 100% committed to a carefully planned and relevant structure, with a clear plan, and lots of preparation. Here are the key considerations in terms of that preparation:

- Before you start fundraising, spend a few weeks compiling a list of every investor you can find. Ask your network for their investor contacts, and if the funding fails, revisit and expand the list next time.

- Research each investor thoroughly, because time speaking to an irrelevant investor is time wasted. Understand what type of investor they are (angel, syndicate, or VC, for example), and how committed they are to investing in the space you’re in. Try to understand what stage they like to invest in, their fund size, and average ticket size. Fund size is an important piece of information as it plays heavily into the maths behind how they make investments.

- Be meticulously organised by building your funnel. Use Trello, Notion, or a similar platform, and set up a way to track every detail of each conversation; and the current status of the conversation at any time. Your fundamental goal when fundraising is to get an answer out of the investor – a ‘yes’ or a ‘no’. Importantly, you want to get to those answers as quickly as possible, particularly in terms of eradicating time wasted getting to a ‘no’.

- Stay on the radar of your potential investors. They may be spoiled for choice with deal flow. While you’re feeling a sense of urgency about moving things forward, it may not be the same to your investor. Keep it friendly, but keep present in their minds through frequent contact even before you start raising money.

Lesson 3: Building Key Materials

Both our pitching successes and failures have taught us a great deal about the value of materials you’ll need to prepare to succeed in a funding round. At the heart of all that is your pitch deck, of course. There's plenty of content out there about building a pitch deck, with places like VentureBeat and GamesIndustry.biz having shared very helpful guides to building a gaming company pitch decks. In short, give yourself plenty of time to build a pitch deck, keep it specific, maintain and update it as you move forward, remember that pitching a company and pitching a product (like a platform or game) are different things, and get a second or third opinion on your deck from people outside your inner circle.

As important as a pitch deck will be a presentation of your financial model, which will be very different depending at which stage your business is. In the early days, informed estimates and realistic projections are fine. The longer your business has been around, the more investors will expect you to be clear and concrete with your figures. Ultimately, the financial model you present isn’t just about demonstrating potential; it's a way to prove that you intimately understand the workings of your own business, and business convention generally. This means being able to break down how you generate revenue into its most granular form, with bottom up assumptions driving the key levers.

Your financial model is also highly valuable and sensitive, and needs context to be truly understood. For those reasons, keep the full version to yourself until the moment is right. Don’t simply send it in full to an investor the moment they ask. You can include an overview as a slide in your deck, which can be freely passed to investors. But the full financial model is something to take an investor through personally and with care. See it more as a working session where you work on the model together – an early way to see how it might be working with this investor in the future. After all, if they actually become an investor, these are things you’ll be discussing in more detail as you shape your business’ future.

Investors usually have a dozen or so of the same questions that they'll either ask you during your pitch, or as a follow up in an email. Questions like "who are you customers" or "what is your go to market strategy" should not surprise you and ideally your answer should be well crafted and delivered confidently. To achieve this, one trick is to prepare (and maintain) a list of relevant questions that investors often ask, and write down answers to each of them. Work on these questions with your team and advisors so they answer each question as directly as possible. Then commit them to memory to be most prepared during the pitch. If they ask one of these questions in a follow up, you can simply copy & paste your answer to them.

Lesson 4: Starting (and Continuing) the Conversation

All the planning and prep will be for nothing if you can’t actually speak to investors. In an ideal world you’ll already have a strong relationship with every investor - but that can take years and passing through various funding rounds at multiple companies. As such, beyond cold contact of your investor list (your final option), get any introductions you can from a shared contact, as they punch through much more powerfully. Equally, keep an eye out for pitching and investment events run by the likes of trade bodies, government and state organisations, industry publications and so on. Those are especially useful as they attract investors open to meeting teams they have no relationship with.

As for the conversation, be very clear from the start about your set time frame and aims. Again, the goal here is to move as efficiently as possible to focusing your efforts on the investors that can commit funding, or those that are reasonably likely to. Don’t waste your own time or investors’, and get to the key details by being direct. You can still be friendly and enthusiastic, but those looking to fund companies will greatly appreciate you being straightforward about the facts and your intent and aims.

To make the process of zeroing in on the ideal investors more efficient build a funnel to track each conversation as they move from stage to stage. At a fundamental level the funnel lets you move all potential investors through a process and get to the point where they have passed out the other end with a firm ‘yes’ or ‘no’ as quickly as possible. For LootLocker that ultimately meant being highly organised with investor conversations by tracking them all in Trello. There’s no set way to arrange this - go with what works for you. At LootLocker we established a workflow so we could keep up with each investor conversation individually, marking each as ‘new’ (for new investors that I needed to research), ‘need intro’, ‘intro received’, ‘first meeting’, ‘follow up’, ‘pass’, or, ideally, ‘invested’. We’d also leave notes on significant and latest conversations with each investor. Together that set up meant that we could see at a glance where communications had got to, and what part of conversations to focus on.

When managing those conversation with investors make it clear you understand their interests, funding type and funding amounts. Put all that earlier research into action. And don’t be afraid to ask questions about the investors’ preferred process and time frames.

Knowing a fund's size or investor’s check size is important as it lets you tailor your fundraising effort to their fund size. If the checks they write are at a minimum of $500K, and you are raising $1M or $1.5M your round will be quite small for them – so consider saying you’re raising ‘up to $2M’.

Alternatively, if you’ve already got some traction and their minimum check size is $500K you can say you only have $500K left in the round. That introduces a little FOMO (‘fear of missing out’) psychology. That’s not to say you should lie if you don’t have any money committed, but if you’ve raised some money already, there is always space to withhold information to play into the sense that a golden opportunity other investors are embracing will soon be passed.

Successful conversations with potential investors is ultimately about communicating clearly and strategically. But here’s some more tips about getting that right, based on the lessons we learned in turning a failed seed round into a successful one:

- It may sound obvious, but in any meeting watch how much time you have left – 30 minutes goes quickly in those situations. And don’t plan to fill a 30 minute meeting with a 30 minute pitch presentation. You want to make sure you save five-to-10 minutes at the end to talk about the investment itself, and any next steps.

- Make sure you include an intro about your background and why you are the person to build or lead your company and project. Don’t spend too much time on yourself, but do remember an investor is interested in the people they are putting money behind as well as a product or company.

- Know exactly what the next steps are, and repeat them back to the investor at the end of the call; perhaps ‘I will send you some times when we can review the model together’, and then follow up immediately afterwards via email confirming those next steps

- Don’t be scared to say you don’t know if they ask a question you can’t answer – just follow up with ‘I’ll look into it and get back to you’. Honesty and openness will really matter to your investors.

- Investors usually make you think they are quite excited by your company; don’t let this fool you into getting your hopes up. Most first meetings will sound very positive because it’s still at an information gathering stage for the investor.

- Save some meeting time to ask them what their immediate reactions and thoughts are.

What Worked for Us

We started fundraising in November and successfully surpassed our goal by the end of December – and it turned out that doing so through Thanksgiving, Christmas and as New Year dawned brought its own challenges. There are simply less working days in that period. But we made it work. So we thought we’d share some of the fundamental principles that helped us triumph, even when competing with the festive period.

Firstly, we already had a network of investors that we had some form of relationship with. A good number of them even came from our earlier failed seed round. So if things don’t work out for you this time, remember that that may galvanise your potential for success next time round. Techstars also set a great deal in motion, ultimately increasing our investor network ten-fold, and particularly in terms of angel investors. It wasn’t just that we met a lot of new investors contacts there; once you start getting some momentum you get introduced to more investors that your new investors want you to speak to, and that accelerates things.

We also put a lot of time into building an impactful pitch deck, and we worked hard to establish meaningful, clear key performance indicators (KPIs) that are not just vanity metrics. Even then it took a lot of careful wording and persistence to explain our product and the size of the market opportunity was – a reminder that not all your investors will be experts in the field you occupy. We established KPIs that were meaningful to us at the present stage of the company, and that could also be linked to how our growth would look in the future. Then, if an investor asked about another KPI we could confidently say that it wasn’t important to us at this point in the business, explaining why, before recentering the conversation on the KPIs we were tracking.

Now, some might say two-months is a rather long funding window, and they have a point. But we chose a timeframe that worked for the realities of our businesses and lives, committed to that, and meticulously planned how to use the time. In fact, even more preparation would have helped; but another reality is that you have to balance getting ready for funding rounds with maintaining and running the business. We put a lot of thought into that balance, and you should too.

What Didn't Work for Us

There’s no such thing as the perfect funding round, even if you do hit your target. You have to go into the experience ready and willing to learn, because one day in the future you may have another funding round to tackle. So, despite our success, at LootLocker we still scrutinised the process once it was concluded, with a view to learning from both our successes and missteps.

For one, we realised how tough pitching a niche product like a game technology is. Pitching a game brings its own challenges in a hit driven business, but with game tech you have to not only communicate what the technology is, but also why it matters, and how it will become increasingly important to the future of a complicated sector like games. Next time, we’d put a lot more thought into finding ways to make those details more clearly understood. You sometimes need to educate your investors about the game industry and the overall ecosystem, size, commercial value, influence and cultural significance, while also communicating the growing, lasting opportunity presented.

We also learned a lot about assuming investor knowledge. To anyone involved in games first-hand, figures about the audience and market size feel very familiar and everyday. But that’s not true of everyone, including tech-savvy investors. As we went through the process we realised we’d have to be more explicit about ‘basic’ facts around audience size, market opportunity, and the industry make-up. We had to do a lot of evangelising for the indie community, for example, countering the surprising misconception that all the industry’s money is only in AAA games from established developers.

Then there’s getting all the ‘no’ responses from investors. Those aren’t failures, because they are an inevitable part of finding the right investors. But getting so many is in honesty demoralising. It’s all too easy to let a constant stream of ‘nos’ distract or even dishearten our fundraising efforts. This is where having co-founders and teammates who can pick you up and give you a moral boost comes in very helpful. Next time we’d definitely put more thought into the remaining opportunities; because focusing on the ‘nos’ in the midst of the round could prove rather too distracting. Save considering what didn’t work for after the funding round has been wrapped

And as mentioned above, we didn’t choose the ideal time of year. Again, we made it work, and had good reasons to go with that time. But we did learn that come the closing months of a year, investors may have allocated most of their funds, or simply be less committed to considering pitches. There a fairly obvious lesson was learned; if you can, target a time frame a little earlier in the year – unless you have good reasons not to. Here’s a rough idea of when it’s good to start fundraising within the calendar year.

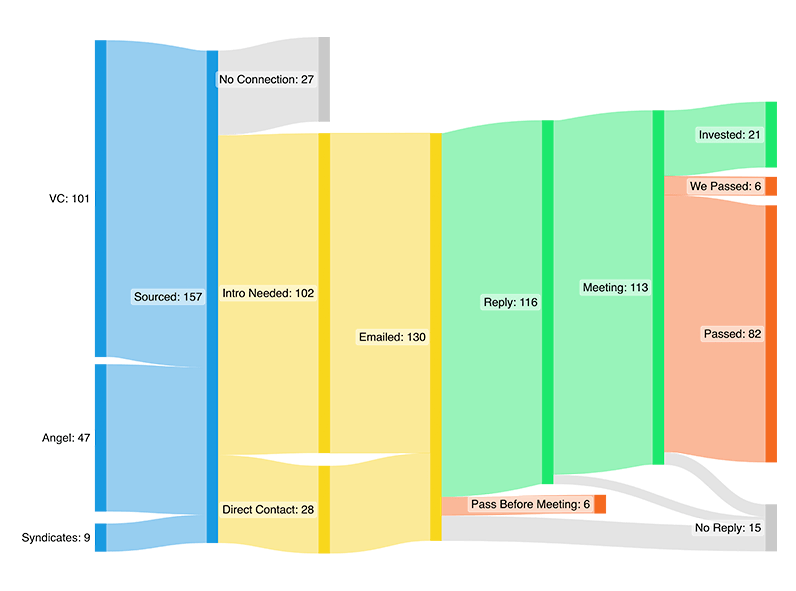

Our Seed Round in Numbers

If this article is intended to help you better prepare for your next funding round, then we’d best share some numbers. After all, that’s what all this ultimately comes down to. So here’s some of the key data, and what it means. This is just from one seed round by one company, of course. Depending on your industry, required funding, previous experience and many more factors, you might be hitting very different numbers. Consider this a snapshot of our experience, rather than a template for your strategy.

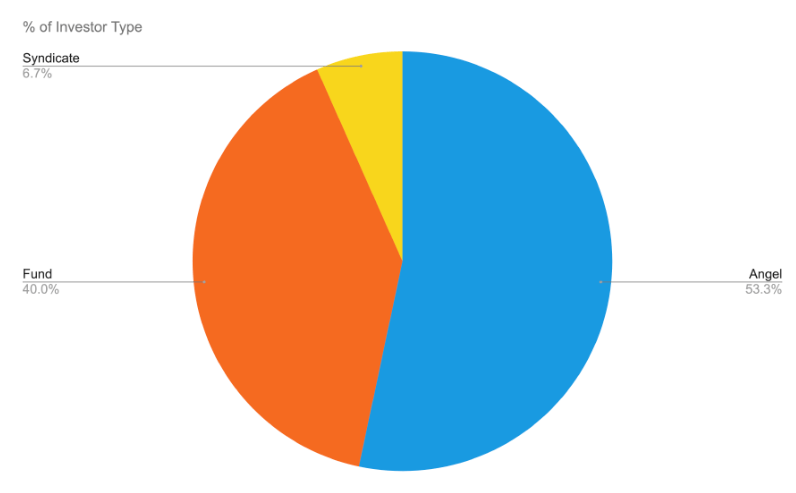

- We ultimately selected 157 potential investors including VCs, angels and syndicates, using our own network, and research through the likes of CrunchBase and AngelList, limiting ourselves to those with an interest in early stage gaming or SaaS/infrastructure companies.

- We were able to get introductions to and start meaningful conversations with 102 of those (including 28 we already had previous contact with funding rounds at prior startups).

- Unfortunately, 11% of those basically ghosted us, rather than simply saying ‘no’. That wasn’t a pleasant experience, but is likely something any company pursuing funding will have to endure.

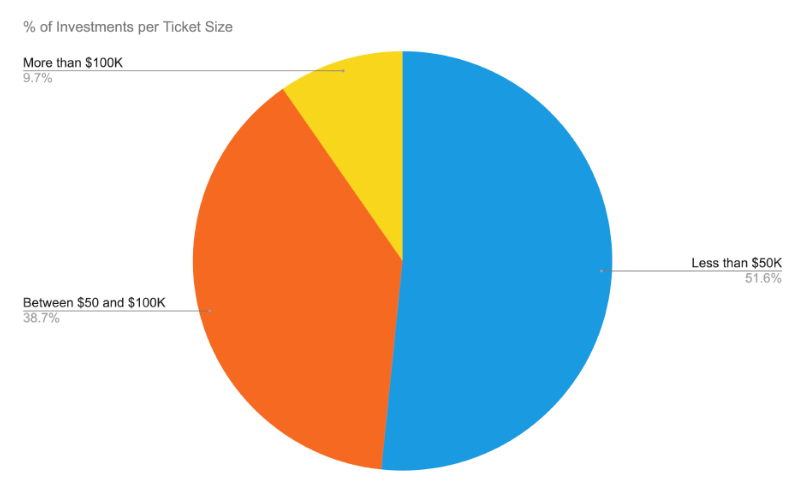

- Much more encouragingly, 16% of those we made contact with actually invested. Interestingly, most of those commitments were achieved through less than three meetings, with about a third committing after just one meeting – a mark of being well prepared, and an advantage of speaking to angels, who like to move quickly.

- However, larger investing organisations can move fast too. The pair of institutional funds that backed us each did so after a second or third meeting.

- 63% of those we contacted said ‘no’. That’s simply reality. You’ll have to go into the experience braced for plenty of rejection. The ‘no’ responses are easy to linger on, but try to put your effort and energy into the ‘yes’ replies. And don’t massively shift your idea, pitch, or vision based on the reasons given for a ‘no’ (also known as feedback whiplash). There’s nothing wrong with tweaking your deck to be clearer based on feedback, but you’re there to find investors that believe in your vision; not adjust your vision to meet the needs of investors.

- You can say ‘no’ too. If an investor doesn’t seem right for you. It might be best to part on friendly terms. We even had cases where investors weren’t able to commit within the required timeframe, so we had to politely decline their involvement.

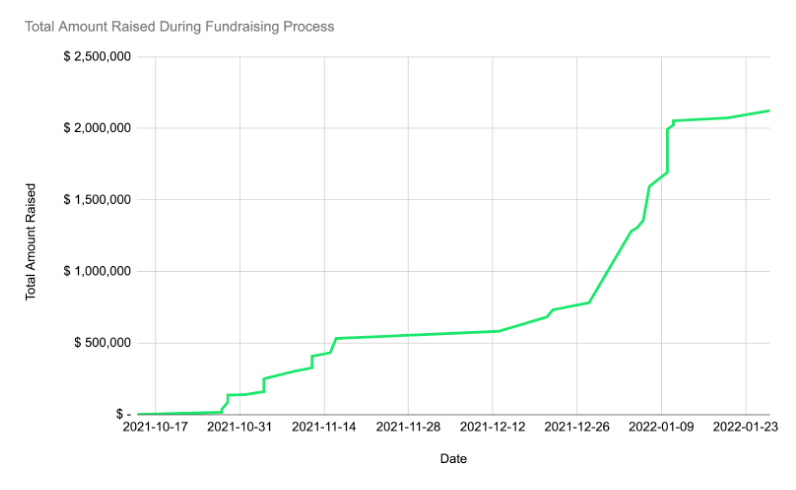

Inside the Funding Amounts

If you look at the graph below, you’ll see that for the first two weeks a range of smaller and medium amounts got us close to $500,000. We got interest up to the $500,000 point by offering earlier investors a slightly lower valuation, granting them a better deal, and generating that valuable sense of FOMO. Because who would want to miss out on a better deal?

Then came a slight lull in investments as we started to speak to the likes of funds, who tend to move more slowly and need more time. It was easy to feel as if we were losing momentum and already starting to fail. But remember to be in it for the long term of your funding window. Analyse the lulls to identify innocuous (or serious) reasons for any slow down.

Soon though, the effort with those who needed more time to consider larger investments paid off, and momentum built, seeing us sail past our $1.5 million target, then onwards beyond $2 million. At the point we passed our target, we suddenly had a psychological tool at our disposal. We could confidently tell prospective investors that we were full, and only accepting strategically valuable investors with limited space. That really fired up interest.

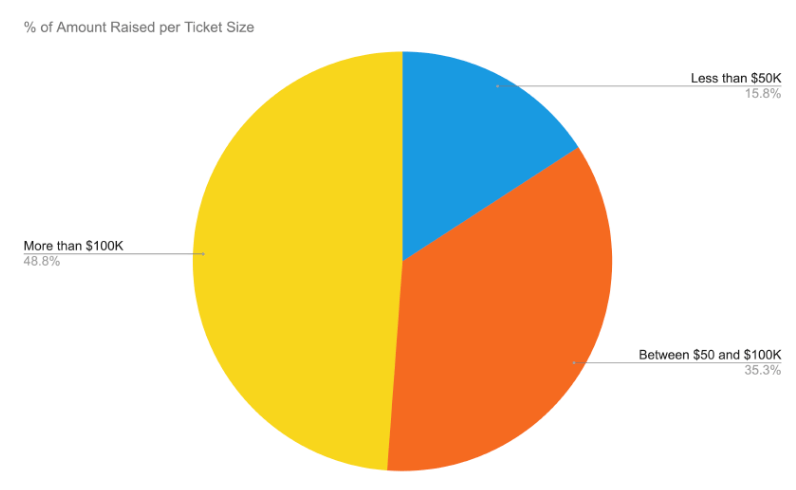

Here, some charts and graphs paint a thousand words – or maybe 2 million. So let's have a look at how the funds broke down by amount, and what type of investors and investments made up the total.

As you can see, more than half of our fundraise came from angel investors putting in smaller tickets – and yet their sum commitment made up just 15% of the total raised. Conversely, less than 10% of commits were larger than $100K, but they contributed just under 50% of the round’s total.

That variety was certainly helpful. We found that having both angels and funds involved with a variety of ticket sizes helped us build momentum and create FOMO for those not yet committed.

In Closing

It was a hell of a lot of work, but worth every moment because it gave us the funds to build our business into something powerful, sustainable and growing. We hope this deep dive into our process sheds some light on what you might be preparing for. But again, this isn’t an instruction manual for success. There are so many variables to consider, that the best thing you can do is focus on your vision, needs and aims. A guide like this is simply a push in the right direction.

If you have any questions, feel free to reach out on Twitter, LinkedIn or email. We got a lot of help and insight that guided our success, and we’d be delighted to pass that on.